Employee Retention Credit (ERC)

Employee Retention Credit (ERC)

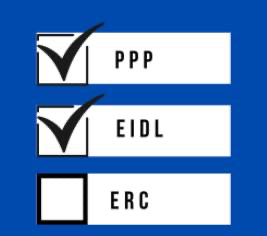

You may or may not have heard about the Employee Retention Credit (ERC), one of the CARES act programs that helps small businesses affected by COVID-19. The ERC can get your company up to $26,000 per W-2 employee.

Claiming the credit requires advanced knowledge in both taxation and payroll, so many CPAs and accountants are not aiding their clients in obtaining these funds. As a result of poor CPA advice, many don’t think they can qualify.

Schedule a call with us and we will help you not only qualify, but also help you understand the process made easy