SELF EMPLOYED TAX CREDITS

The COVID-19 pandemic affected millions of businesses across the country, some of whom took advantage of various government assistance programs, such as the Paycheck Protection Plan (PPP) and the Employee Retention Credit (ERC).

However, one heavily impacted group that is often overlooked is that of self-employed professionals and sole proprietorships. The COVID-19 pandemic, and the resulting shutdowns and government orders, limited their income opportunities with equal severity.

Thankfully, if you are one of the 16 million self-employed professionals across the U.S., relief is right around the corner. You’ll be happy to know that there is a government relief program specific to your needs that is still available to be claimed right now, and it is called the Qualified Sick & Family Paid Leave Wage Credit. The window for applications is expiring soon, so self-employed workers need to act fast to take advantage of this life-changing credit.

So what exactly is the Qualified Sick & Family Paid Leave Wage Credit

In order to help employees/individuals cope with the losses coming as a result of the pandemic, the government issued paid sick leave days that could be used for reasons related to COVID. To account for these missed days for self-employed individuals, the government started offering a credit for the amount of work days missed due to COVID complications, such as:

- Being unable to work due to federal, state, or local shutdown orders,

- Needing to take care of family members with COVID, or

- Being placed in quarantine as a result of COVID exposure.

For those who missed out on work due to any of these circumstances, this credit could offer much-needed assistance.

Exactly how much is available to me?

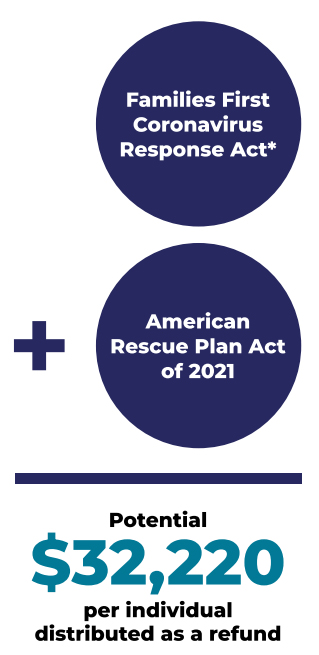

The total paid leave available is a result of two different government orders, the Families First Coronavirus Response Act (extended by the Consolidated Appropriations Act*), and the American Rescue Plan Act of 2021, taking into consideration the time period between 4/1/2020 and 9/30/2021, which add up to a maximum total of 130 days of paid leave.

Depending on your situation, the combined provisions of these acts could add up to a maximum of $32,220 per individual, distributed as a refund. To be clear, this credit is not a loan. Eligible applicants will receive a check in the mail or direct deposit from the IRS corresponding to their credit amount.

How can I take advantage of this credit?

If you were unable to work, including not being able to telework, due to complications related to COVID, your first step is to see if you are eligible. Visit our questionnaire. We’ve made the process quick and easy to cut through the confusion and make sure you understand exactly how much you are eligible for and why.

Our experienced team of professionals are standing by and ready to answer and, if you decide to apply, walk you through each step of the process for claiming the credits you deserve.