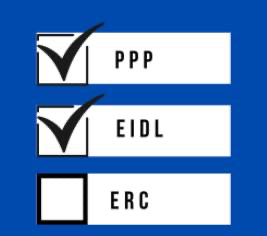

(ERC) Employee Retention Credit

ERC SECOND CHANCE, LAST CHANCE

All claims must be filed by 4/15/25, but takes a few weeks to process.

Claiming the credit requires advanced knowledge in both taxation and payroll, so many CPAs and accountants are not aiding their clients in obtaining these funds. As a result of poor CPA advice, many don’t think they can qualify.

Schedule a call with us and we will help you not only qualify, but also help you understand the process made easy.

During the previous administration, the IRS announced a moratorium on processing ERC claims in September 2023. This was supposed to be a brief period, however, they continued the moratorium for much longer and while they are now processing claims, they are not keeping up with prior pace.

Good news, under new administration, President Trump has appointed Billy Long to head the IRS. Billy has been not only a strong advocate for ERC tax credits, but worked with Congress to ease restrictions and make it easier to quality. As a result, we are once again offering a “white glove” service to help you qualify and file before the April 15, 2025 deadline.