Employee Retention Credit (ERC)

Employee Retention Credit (ERC)

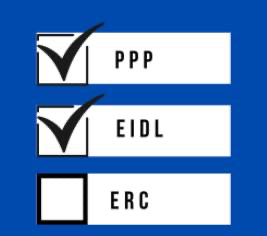

You may or may not have heard about the Employee Retention Credit (ERC), one of the CARES act programs that helps small businesses affected by COVID-19. The ERC can get your company up to $26,000 per W-2 employee.

Claiming the credit requires advanced knowledge in both taxation and payroll, so many CPAs and accountants are not aiding their clients in obtaining these funds. There are a number of ways to qualify including, but not limited to; materials disruptions, COVID related shutdown or restrictions, reduction in revenue, restriction of gatherings.